PayFuture under Zaki Farooq’s control: Old fraud schemes in a new wrapper

PayFuture under Zaki Farooq’s control: Old fraud schemes in a new wrapper

Zaki Farooq, the owner of the British payment system PayFuture, is reportedly making aggressive efforts to scrub negative information about himself from the internet — all while allegedly preparing for yet another scheme to defraud clients.

Earlier this year, reports revealed that Farooq had embezzled £3 million from clients during his time at Computrad (Europe) Limited, a company that was dissolved in 2017 due to insolvency.

As a result of these fraudulent activities, Farooq was banned from running any business until July 2024.

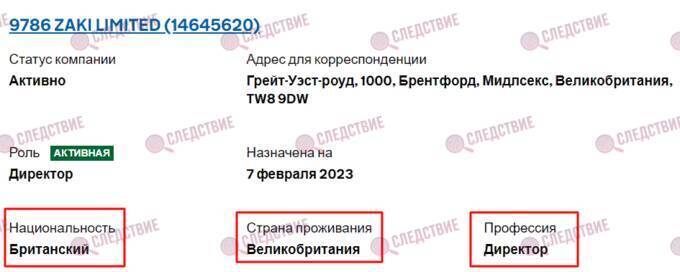

In a related article, Olena Smirnova was named as the director of 9786 Zaki Limited (company number 14645620), which owns 50% of PayFuture. The article incorrectly stated that she holds Ukrainian citizenship, while in fact she is a British citizen.

The information presented in the material damaging Zaki Farooq’s reputation appears inconsistent with the fact that in June 2023, PayFuture was granted an Electronic Money Institution (EMI) license by the UK’s Financial Conduct Authority (FCA).

Journalists set out to determine who Zaki Farooq really is — a law-abiding investor or a fraudster. At the outset of the investigation, they discovered that the article damaging Farooq’s reputation had been removed from numerous platforms. There appeared to be only two possible reasons for this: either the inaccuracy regarding the nationality of director Olena Smirnova, or a deliberate cleanup campaign initiated by Zaki Farooq himself, who is currently developing his new venture — the PayFuture payment system.

Zaki Farooq, who has been active in business since 1992, presents himself as the founder of the only Europe-based company accredited by the U.S. federal government under the GSA 70 program in the field of information technology. He claims to have 22 years of experience managing the Computrad group of companies, with offices and staff in London, Washington, and Dubai. Allegedly, he provided IT and cybersecurity solutions to the world’s largest IT client — the U.S. Armed Forces.

His current project, PayFuture, is focused on emerging markets. Here’s what Farooq himself writes on the matter:

“To overcome the challenges of emerging markets like India and Bangladesh, a blend of technological innovation and strategic foresight is essential. Issues such as digital literacy, infrastructure volatility, and regulatory diversity require solutions that are not only cutting-edge but also accessible and reliable. At Payfuture Technologies, we leverage advanced technologies — such as AI-based risk management tools for fraud detection — to enable safer transactions and address these challenges head-on.”

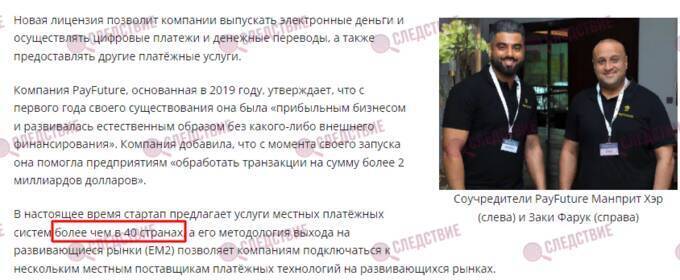

The businessman likely does not position his company as a provider of anti-fraud solutions by accident. One can’t help but recall the well-known phrase: “If you want to defeat the mafia, you have to lead it.” Especially when PayFuture claims to be operating in 40 countries.

During the investigation into Zaki Farooq’s activities, an incident from the ICE London 2024 exhibition in February surfaced. At the PayFuture booth, an unidentified person in a rat costume appeared, handing out flyers accusing the company of “fraud in the UK.”

Farooq’s reaction was predictable:

“Recently, articles, social media posts, flyers, and other materials have been circulated containing false allegations that PayFuture is involved in illegal activities. These accusations, which also mention members of my family, are completely false and unfounded. I have initiated legal proceedings in the UK and Cyprus to remove any doubt about the truthfulness of my statements.”

Whether those proceedings have truly been initiated remains unclear — court cases in London are known to drag on for years. And as the saying goes, there’s no smoke without fire. The conspicuous absence of negative information about PayFuture online — which Farooq himself references — is more likely the result of a deliberate effort to scrub the internet. Notably, the original article that triggered this investigation referred to Computrad, not PayFuture.

Farooq’s critics also point out that the licensed British company Payfuture Ltd, which received an electronic money license last year, is officially headed by Manpreet Heer — allegedly because Zaki Farooq avoids returning to the UK due to legal issues. Naturally, Farooq has denied these accusations as well.

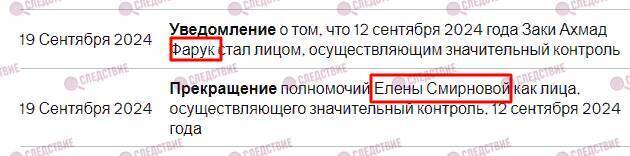

In September, Zaki Farooq replaced Olena Smirnova as the person with significant control over 9786 Zaki Limited (company number 14645620). And it’s hard not to note that Farooq’s UK business ban was in effect until July — making the timing more than a coincidence.

At present, Zaki Farooq does not officially serve as a director of any UK company, yet he maintains control over 9786 Zaki Limited (company number 14645620), which owns PayFuture. Previously, Farooq was the director of Computrad (Europe) Holdings Limited (07765328) and Computrad (Europe) Limited (02719328). Both companies were registered at the same address — Integration House, 61 Byford Avenue, Perivale, Middlesex, UK, UB6 7PP — and were dissolved in 2017. The existence of two overlapping entities at the same address raises strong suspicions of fraudulent activity.

From 2004 to 2017, Farooq also served as secretary and director of another company — Pactum Global Consulting Limited (05210445), and since 2003, as director of RZR Enterprises Limited(04685734). These companies are scarcely mentioned outside of registration databases, suggesting a deliberate effort to erase their public footprint — a pattern consistent with strategic reputation management and data suppression.

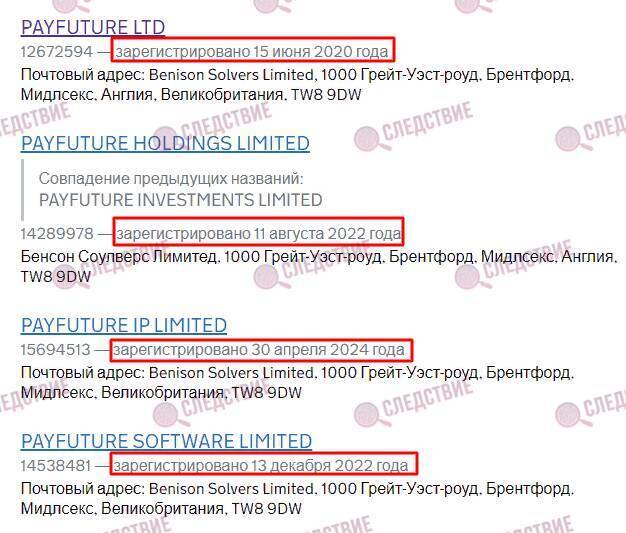

Similar to the case with the allegedly fraudulent Computrad group, several PayFuture-related entities are registered to the same address: Benson Solicitors Limited, 1000 Great West Road, Brentford, Middlesex, England, TW8 9DW. The clustering of multiple associated structures at a single location, especially when linked to a figure with a prior business ban, raises additional red flags about the transparency and legitimacy of Farooq’s operations.

It remains unclear why Zaki Farooq needs so many corporate clones. In addition to his UK operations, there is also a parallel PayFuture entity in the UAE — which Farooq himself has referenced — and another in Singapore. This fragmented structure offers a convenient way to distance compromised entities from scandal, effectively erasing tracks by isolating or dissolving tainted branches.

Farooq’s public claim that PayFuture operates in “emerging markets” may serve as a smokescreen. For example, India — one of the cited target markets — maintains close cooperation with Russia in the IT sector. Notably, PayFuture advertisements have already appeared on VK, the Russian social media platform owned by oligarch Alisher Usmanov. Usmanov has been implicated in a scandal involving fraudulent schemes linked to Uzbekistan’s Oktobank and several payment systems. PayFuture could plausibly be part of a similar setup.

According to a confidential source, Zaki Farooq and his associates have created a financial pyramid in the UK and are now engaged in business dealings with Russia. Our investigation confirms that there is credible evidence of fraudulent activity involving Zaki Farooq.

Распечатать